Finance

How Retirement Loop Helps Their Members Retire Comfortably and Confidently

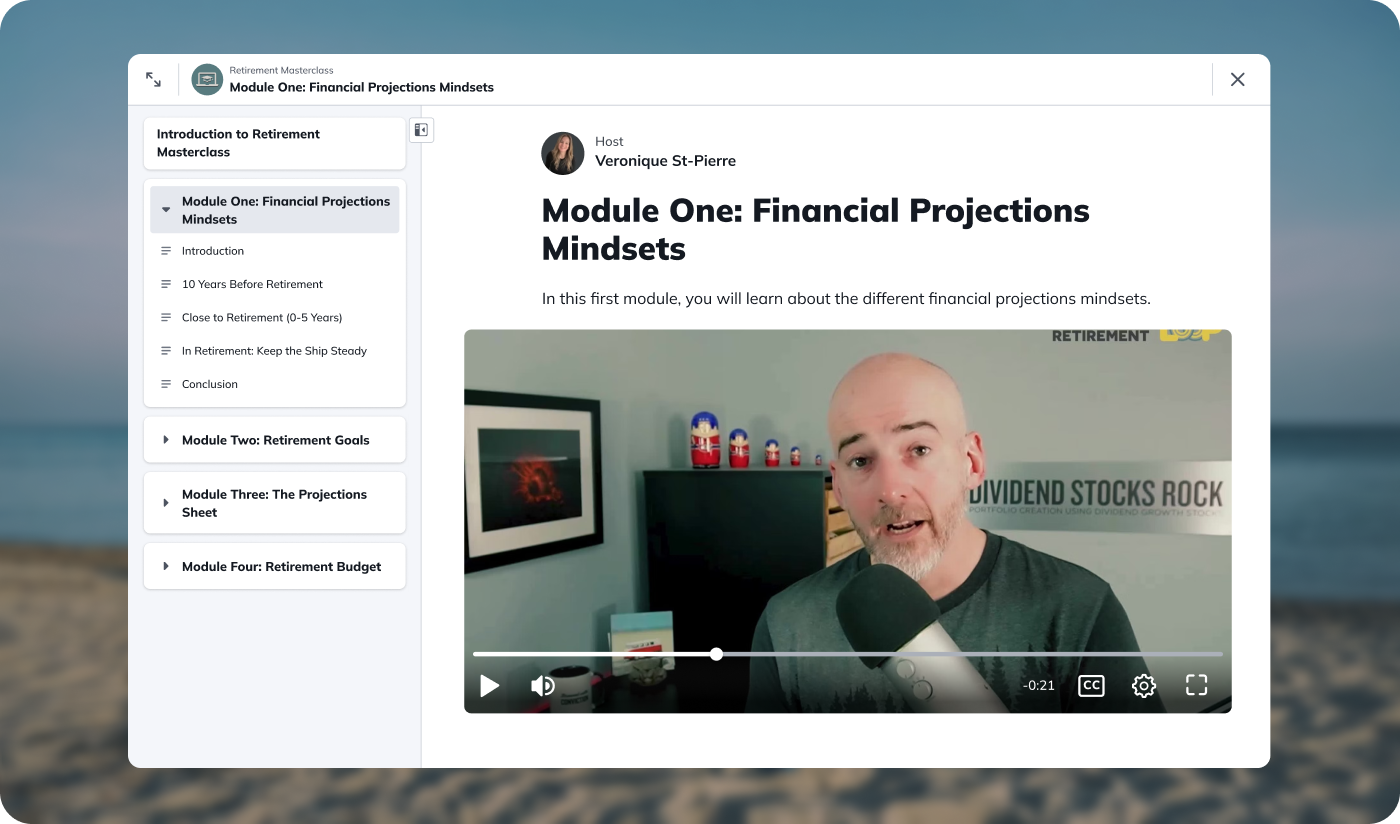

Retirement Loop specializes in helping people transition into retirement with confidence. Members can find answers to every kind of question they might have about moving into this new phase of life from budgeting and estate planning to minimizing taxes and finding the right insurance.

Topic

Finance

Mighty Plan

The Growth Plan

Offering

Paid Membership

Coaching

Courses

Topic

Finance

Mighty Plan

The Growth Plan

Offering

Paid Membership

Coaching

Courses

“Members post and comment much more than they message or email me. They're helping each other out.”

Mike Heroux

Founder

After decades spent in financial planning, Retirement Loop founder Mike Heroux knows your 30s are the best time to plan for retirement. But if that puts a pit in your stomach, don’t worry — he’s quick to say that most people don’t do that.

“People that age are busy building their career, having a family, buying a home,” he says. “In their 40s, they start to save a little bit. But it's a blurry path of putting away 500 bucks a month. Then you get into that transition and realize, ‘Oh my God, how do I set up my accounts? Do I have enough to live? What kind of budget do I need?”

THEIR IDEAL MEMBER

Most people who join Retirement Loop are Canadians who are typically between the ages of 50 to 65 and 5 to 10 years away from transitioning into retirement. They want to learn how to manage their financial plan on their own instead of hiring a professional. “They realized how much they were paying in fees for an advisor that was not necessarily doing the job,” says founder Mike Heroux. “But as they build their portfolio and get closer to retirement, they come up with a whole new bunch of questions.”

Recognizing a Need

After seeing so many people in their 50s and 60s with the same questions in his already thriving community, Dividend Stocks Rock, Mike created Retirement Loop, a new separate membership dedicated to members planning for this stage of life. Although he and his vice president of marketing Véronique St-Pierre started the network just a few months ago, they’ve already seen the people magic ignite. With 500 founding members, the “Loopers,” as Mike calls them, are working together to retire with conviction and enjoy this well-earned era.

“It's a lot easier to have dozens of people say, ‘Well, I just did it last year. Here are the troubles I went through and here’s how I managed them or here are some tricks I wish I knew before I started this process,” Mike says.

Building a Foundation

Véronique and Mike wanted to give members who joined early an incentive to come to the party before it was hopping. (“The music’s on, there's a bar but nobody's chatting yet, there's not much dancing going on,” Mike jokes.) They hoped to see 100 or 200 people sign up after they launched; instead, they welcomed 500 in just two months.

“We had to close the gate so we could start working on everything because we want to provide value and support them,” Mike says. “At first we just got flooded by questions. And that was great — a good problem to have. But we didn't expect it.”

Originally, Véronique and Mike thought members would fill out their projection tool and have many of their questions about investing and budgeting answered. But quickly, they saw Loopers were hungry for even more content and topics. Listening to what the community wanted showed them how to structure a membership that delivered value year-round.

“They are giving us inspiration as well as helping us move forward and create more quality,” Véronique says. “It’s only been a couple of months and we've already done so much.”

Accessible Design for Any Audience

The two credit Mighty Networks’ easy-to-use infrastructure for the immediate response. After Mike met the Mighty Networks team at a conference, he told Véronique he had found the streamlined solution they had been searching for to start Retirement Loop. As the main host, she was thrilled to hear about the platform’s capabilities that would finally let them do more with less time and resources. She was also excited that less tech-savvy members would also find the features user-friendly — a big reason why their discussion spaces are buzzing without the need for constant direction by Véronique, Mike, or their other retirement coach.

“I really love Mighty Insights. We can always see the level of activity, and whenever we try something, it’s very easy to see if it was a success or not,” Mike says.

"Members post and comment much more than they message or email me,” says Véronique. “They're helping each other out."

While they have ideas for the future, like travel guides and discussion spaces about shared hobbies, for now, Véronique and Mike are content to know that their first members are on their way to seeing their best year ever.

“Their best year ever is when they have taken away their fear,” Mike says. “People fear retirement because of the unknown. You have to deal with a completely different mindset that creates a lot of uncertainty and anxiety. The only way to solve this problem is to have a plan. That’s the goal behind Retirement Loop: making sure you have the tools to keep the ship steady.”

More like this

Start your own Mighty Network today

Start your free trial

14 Days. No Credit Card Required.